It ain't a tax thing

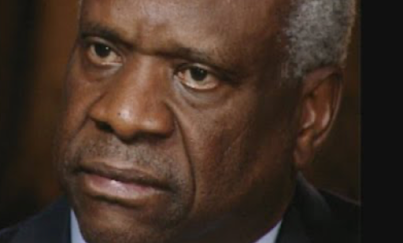

The New York Times had a good scoop yesterday: Justice Clarence Thomas never paid back most or any of the principal on the sweetheart loan that he got from a rich guy to buy Thomas's ultra-luxury RV. The lender, a fellow named Anthony Welters, forgave the debt after Thomas had paid interest only for a number of years. I hadn't heard that part of the story before; I presume no one had.

Alas, the Times marred its story with some faulty analysis of the tax consequences of the transactions to Thomas. Somebody gave the Times reporter, Jo Becker, the mistaken impression that even if Welters forgave the loan strictly out of generosity and affection, Thomas would have taxable income from the cancellation of the debt. That's just wrong. Cancellation of debt as a gift is not income to the borrower for tax purposes. If you owe your father money, and on your birthday he rips up your IOU to show he loves you, that's not income to you. It's a gift. The test is the lender's motivation in forgiving the debt.

And so unless Thomas promised or delivered something to Welters in return for the debt cancellation, it was most likely a gift, and there is no tax scandal, as much as the Times reporter thinks she has one.

Whether such a gift needs to be disclosed on a judge's ethics reports is a very different question, however. And there are also gift tax implications for the lender. Do you think Welters filed the required gift tax return?

But unless there was a quid pro quo for the loan forgiveness, Thomas didn't cheat on his taxes by not reporting the deal as taxable. Siccing the IRS on him would do nothing, because there's nothing for that hound to bite.

I thought the federal gift exemption would apply to the forgiven amount of the loan.

ReplyDeleteAs long as Thomas exhibits traditional values and declines to adopt progressive positions he will be an active topic of left wing activists.

ReplyDeleteAnd I would have gotten away with it too, if it weren't for you meddling dems!

DeleteAs long as Thomas exhibits a disgust for disclosure rules and a desire to accept money, gifts, loans from billionaires who have no other reason to befriend him, other than his status on the SCOTUS, he will be an active topic for honest Americans.

DeleteWhen bias rears it’s head. Existing rules aren’t enough

DeletePut Ronan Farrow on this guy. There's lots more to be discovered....

ReplyDeleteTaxes? We don't need no stinking taxes... Especially now that Oregon schools don't require proficiency requirements for ANYTHING.

ReplyDelete